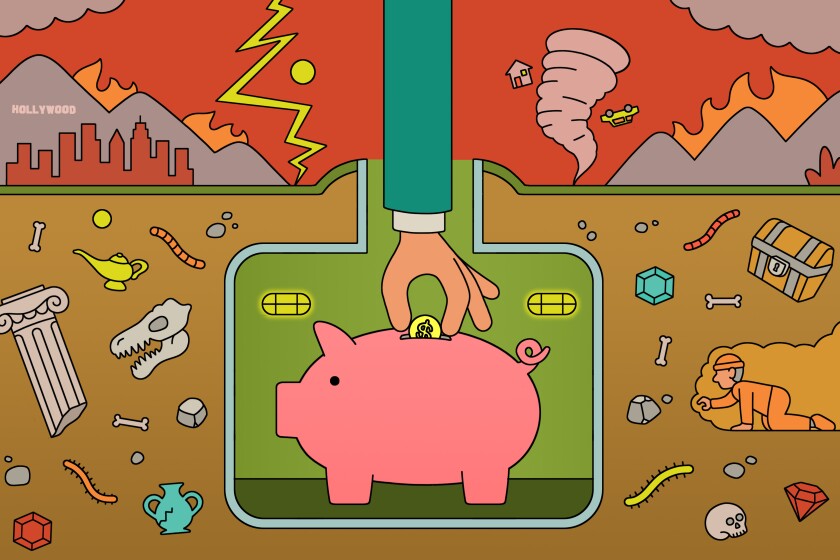

It’s time so as to add a brand new line merchandise to your finances: your emergency fund.

You’ve most likely learn someplace that it's best to have three to 6 months’ value of bills put aside. For most individuals, that's an astronomical quantity. Don't add up your bills, multiply by six and fixate on that quantity.

Near 40% of Individuals couldn't afford a $400 sudden expense with out having to hold a steadiness on a bank card or borrow cash or promote one thing. That’s not simply amongst folks with scholar mortgage debt, or folks of their 20s and 30s, or individuals who simply began budgeting. That’s nearly 40% of everybody in the USA.

You probably have $100 put aside for an emergency, you’re forward of lots of people. In case you get to $400, you’re forward of effectively over a 3rd of the individuals who stay in America. While you have a look at it that approach, you understand how uncommon having half a 12 months’s bills put aside actually is.

How a lot ought to be in my emergency fund?

Begin small. Once more, each greenback you get into this class is a victory. Set $400 as your first objective. Work your approach up from there.

In case you are in hardcore debt paydown mode, it might sound silly to have cash simply sitting in your checking account, not doing something. However it's doing one thing: It’s ready for an inevitable emergency. That cash is the Nationwide Guard of your finances, able to mobilize at a second’s discover.

In case you throw each single spare greenback you've got at your debt, what's going to you do when an emergency occurs? You'll cycle proper again into debt. That’s not progress.

Some private finance gurus say to have a $1,000 fund whenever you get began, and $1,000 is an effective quantity. I feel that, given how costly issues are in Southern California, $2,000 makes extra sense as a workable quantity to have readily available. It’ll cowl most sudden bills.

While you spend out of your emergency fund, it's a must to prioritize paying your self again. That may imply rejiggering your finances for the subsequent couple of months to “prime up” that emergency reserve earlier than throwing additional at debt, or reducing again on discretionary bills for a bit. No enjoyable, I do know! But it surely’ll be definitely worth the peace of thoughts when one thing unhealthy occurs and you'll say, “No drawback.”

When you’ve acquired a superb deal with in your debt, then it’s time to consider turning into a type of tremendous savers with three to 6 months of cushion in your financial savings account.

By the way in which, that ought to be three to 6 months of completely vital bills, not complete outflow. If there’s an emergency, you most likely aren’t considering a lot about your eating out finances. A theoretical month of emergency financial savings ought to be sufficient to cowl your requirements (lease, utilities, meals, transportation) and debt funds, not the utmost quantity you spend monthly.

What constitutes an emergency?

To me, an emergency is an expense you couldn’t have foreseen. A final-minute flight throughout the nation for a funeral. Having to maneuver unexpectedly and needing the deposit for a brand new place earlier than you get your safety deposit again.

One which thousands and thousands of individuals encountered in 2020: shedding your job and having to pay your payments out of pocket till unemployment kicks in.

The place do I maintain my emergency fund?

In my view, you want solely two financial institution accounts: checking and curiosity financial savings. In case you’ve mixed funds with another person, perhaps you need another checking account on your private enjoyable cash. That’s it, although. Some folks have one shared checking account for requirements and one shared for enjoyable stuff and one other private account after which separate financial savings accounts for every financial savings objective. To me, should you’re budgeting accurately, that simply creates a number of additional work. I maintain the “sometime funds” and my emergency fund within the financial savings account that earns a bit curiosity, and every part else in checking. (Attending to finances the curiosity in your financial savings is one in all budgeting’s nice joys. Sure, thanks, I would love the cash that my cash earned to go towards my future trip.)

This isn't a publication about investing. If you wish to make investments, nice! A separate funding account is an effective factor, as is contributing to an employer-sponsored retirement account. A finances line for what you may afford to place into it each month, even higher. However regardless of the excessive yields available in the market proper now, it’s not sensible to place your rainy-day cash into shares. The sorts of emergencies that result in issues like job or house loss generally come from a lot bigger societal emergencies — the type that convey the market crashing down and take your hard-earned financial savings with it.

What about my ‘sometime funds’ that I made in Week 1?

In case you adopted alongside on Week 1 once we made our budgets, you’re already setting apart a bit bit for issues like automobile repairs and vet payments and medical bills. Some folks consider these as emergency bills. I don’t.

I imply, sure, clearly, in case your automobile engine dies, it’s an emergency. However should you’ve ever owned a automobile, or a pet, or a human physique, you realize they break down and wish repairs generally. The one sudden half is the “when.” So I like to avoid wasting for these individually, stashing away a bit bit of cash each month in order that when the automobile’s serpentine belt or the canine’s ACL blows out, I’m prepared.

In case you want greater than what’s within the automobile or pet fund at that time, particularly whenever you’re simply beginning to construct these up, take it out of your emergency financial savings. However in the long term, the objective is to have the ability to say, “Oh, the automobile wants new brakes? That’s high quality. We’ve been saving for this.”

Not everybody would agree with how I categorize a majority of these bills. In case you’d fairly throw more cash at your month-to-month emergency fund and never save individually for particular person classes, that’s OK too! As I mentioned earlier than, your mind, your priorities and your finances are all going to be completely different from mine. I’m supplying you with the knowledge and empowering you to determine learn how to use it.

We put solely a few these “sometime funds” into the finances in Week 1 as a result of I didn’t wish to completely overwhelm you. Actually, there are a number of “somedays” to avoid wasting up for. As I write this, I'm saving up for each the deductible and the out-of-pocket max on my medical insurance for when I've a child. My automobile is 10 years previous and I plan to run it into the bottom, however it received’t final ceaselessly, so a new-car fund is on my finances. When my husband and I made a decision to improve our telephones, that was a brand new “sometime” class. The farther away these bills are, the much less it's a must to put apart each month to completely fund them by the point they pop up. You don’t need to put each single expense you’ll ever have into your finances proper now, however consider as you go in your budgeting journey that there’s stuff you’ll need down the highway, and the fitting time to start out saving for them is now.

Dangle in there

Are you panicking? Possibly a bit? It’s arduous to repay debt and in addition really feel as if it's good to save up for 10,000 issues you want and wish sooner or later, plus a bunch extra issues you may’t even consider proper now. It’s loads. Simply begin small.

You’re doing nice.

Subsequent week, we’ll speak about learn how to sort out debt so that you’ll have more cash for the large objectives and enjoyable stuff.

— Jessica

P.S.

This article is free. However making it isn't. Completely Price It received’t have any gross sales pitches for particular monetary merchandise — i.e., I’ll by no means let you know that it's good to purchase this particular software program or open an account with this particular financial institution. My solely gross sales pitch is that this one: In case you aren’t already, please take into account subscribing to the Los Angeles Instances. $1 for six months. I promise I could make that slot in your finances.

The Completely Price It group desires to listen to from you! You probably have any ideas, questions or issues, electronic mail worthit@latimes.com. And to make sure you get this text, please add this electronic mail tackle to your contacts or tackle guide. Thanks.

Post a Comment