SACRAMENTO —

A handful of Democrats within the state Legislature are pushing once more for a tax on “excessive wealth” in California, a transfer they are saying may carry the state billions in income by elevating taxes on households value $50 million.

But when final 12 months is any indication, the laws faces an uphill battle.

The brand new invoice by Assemblymember Alex Lee (D-San Jose) reintroduces a proposed tax hike for the state’s richest residents, doubtlessly affecting about 15,000 Californians, or .07% of taxpayers. The proposal would apply a 1% tax on these with a web value of a minimum of $50 million and a 1.5% tax on these value greater than $1 billion.

The proposal is projected to herald greater than $22 billion a 12 months in state income, in accordance an evaluation by professors at UC Berkeley and UC Davis.

The invoice, which might go into impact subsequent 12 months for billionaires and in 2025 for eligible millionaires, would go to the voters for approval in 2022 if it passes the Legislature. The proposal requires voter approval of a constitutional modification as a result of it could exceed the state’s tax charge limits of 0.4%.

Lee’s laws wouldn't represent an earnings tax, however a tax on belongings and “all wealth” whether or not it has “been realized as earnings or not,” he mentioned. Lee pointed to experiences of a few of the richest folks on the earth avoiding earnings taxes because the reasoning behind the strategy.

“There’s an entire different class of wealth the place you simply personal issues and might leverage extra wealth out of your current wealth and we’ve seen how that may be evaded,” Lee mentioned in an interview Thursday. “We would like the obscenely extremely wealthy to be paying their justifiable share.”

California’s wealth hole is not any secret: The state is house to the biggest share of the nation’s billionaires and in addition the best poverty charge.

Californians voted to extend taxes on these incomes greater than $250,000 a 12 months in 2012 and prolonged that enhance in 2016, however regardless of a Democratic supermajority within the Legislature, a wealth tax like Lee’s has confronted criticism.

Final 12 months, an an identical try by Lee didn’t even make it to legislative committee hearings.

A 2020 invoice by Assemblymember Miguel Santiago (D-Los Angeles) that will have raised taxes on Californians incomes a minimum of $1 million with a view to fund colleges and different authorities companies additionally failed. A pitch by Assemblymember Luz Rivas (D-Los Angeles) to spice up taxes on rich firms to profit homeless Californians didn’t make it far, both.

Gov. Gavin Newsom, who has targeted a big share of his finances serving to folks in poverty, has additionally averted the concept of accelerating taxes on the rich.

California’s progressive tax construction already makes the state finances disproportionately depending on the wealthiest. Even in a business-crushing pandemic, the state is going through one other file high-budget and surplus thanks largely to capital positive factors earnings because the wealthy turned richer, leading to extra tax income.

However supporters of AB 2289, together with the California Federation of Academics, say that’s not sufficient.

“California billionaires have elevated their wealth astronomically because the starting of the pandemic, whereas common working households have struggled to pay their payments,” CFT President Jeff Freitas mentioned in a press release. “It’s time we took care of one another, and never simply watch billionaires fly into area.”

The California Taxpayers Assn. shortly opposed the brand new laws on Thursday, saying that it could trigger high earners to maneuver away and would have a damaging influence on state income.

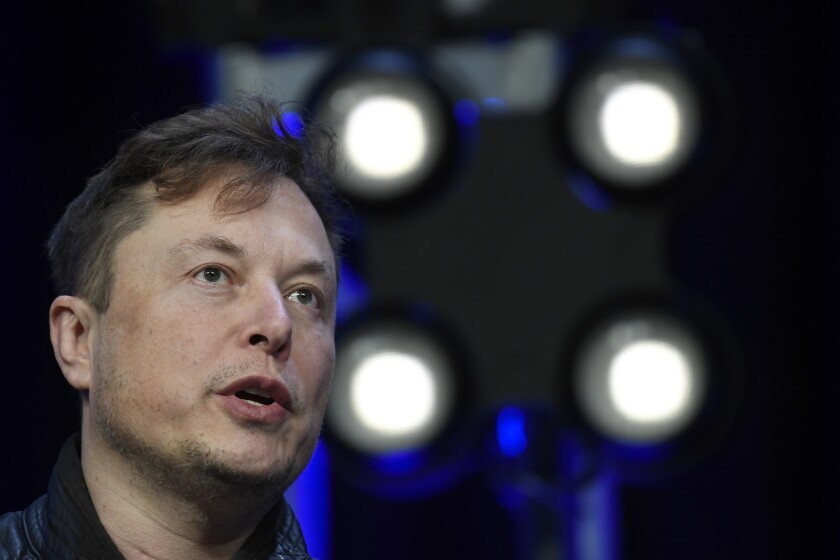

Tesla Chief Government Elon Musk final 12 months moved the corporate headquarters from Palo Alto to Texas, the place taxes are a lot decrease.

A report by the nonpartisan California Coverage Lab discovered that there’s “little proof that rich Californians are leaving en masse,” however the specter of such a loss stays.

“The brand new-and-not-improved proposal will immediate extra rich Californians to pack their baggage and transfer — a foul thought contemplating they symbolize a significant portion of our tax base,” California Taxpayers Assn. President Robert Gutierrez mentioned in a press release. “If excessive earners go away — and they're going to to keep away from the tax hike in addition to the headache of getting to yearly appraise all the pieces they personal, anyplace on the earth — the taxpayers left in California shall be requested to pay extra.”

Post a Comment