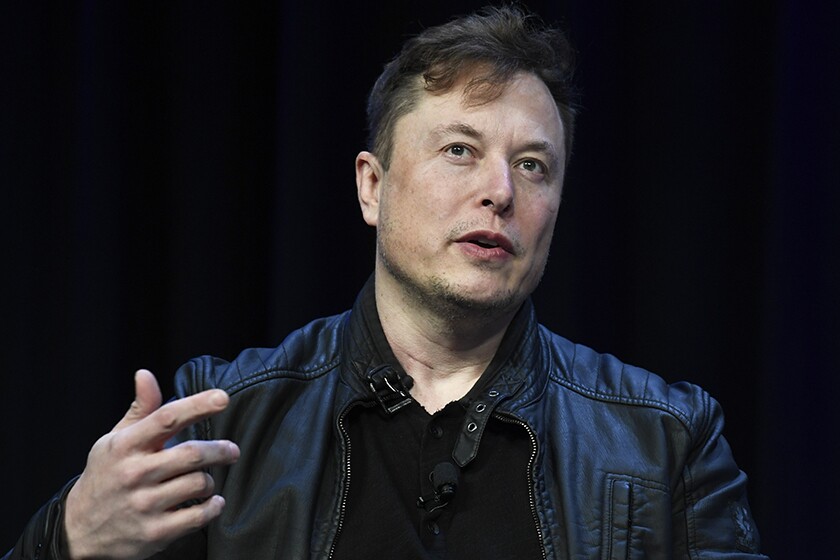

Elon Musk is providing to purchase Twitter, simply days after the Tesla CEO stated he would now not be becoming a member of the social media firm’s board of administrators.

Twitter Inc. stated in a regulatory submitting on Thursday that Musk, who presently owns barely greater than 9% of its inventory and is the corporate’s largest shareholder, supplied a letter to the corporate on Wednesday that contained a proposal to purchase the remaining shares of Twitter that he doesn’t already personal. Musk provided $54.20 per share of Twitter’s inventory.

He known as that worth his greatest and last supply, though the billionaire supplied no particulars on financing. The supply is nonbinding and topic to financing and different situations.

“I invested in Twitter as I consider in its potential to be the platform without cost speech across the globe, and I consider free speech is a societal crucial for a functioning democracy,” Musk says within the submitting. “Nevertheless, since making my funding I now notice the corporate will neither thrive nor serve this societal crucial in its present kind. Twitter must be reworked as a non-public firm.”

The buyout supply from Musk is simply the newest improvement in his relationship with Twitter. The billionaire revealed in regulatory filings over current weeks that he’d been shopping for shares in virtually every day batches beginning Jan. 31. Solely Vanguard Group’s suite of mutual funds and ETFs controls extra Twitter shares.

Musk has been a vocal critic of of Twitter in current weeks, principally over his perception that it falls brief on free speech rules. The social media platform has angered followers of former President Trump and different far-right political figures who’ve had their accounts suspended for violating its content material requirements on violence, hate or dangerous misinformation. Musk additionally has a historical past of his personal tweets inflicting authorized issues.

Musk stated final week that he knowledgeable Twitter he wouldn’t be becoming a member of its board of administrators, 5 days after he was invited. He didn’t clarify why, however the resolution coincided with a barrage of now-deleted tweets from Musk proposing main modifications to the corporate, resembling dropping adverts — its chief income — and reworking its San Francisco headquarters right into a homeless shelter. Musk left a couple of clues on Twitter about his considering, resembling by “liking” a tweet that summarized the occasions as Musk going from “largest shareholder for Free Speech” to being “advised to play good and never communicate freely.”

After Musk introduced his stake, Twitter shortly gave Musk a seat on its board on the situation that he not personal greater than 14.9% of the corporate’s excellent inventory, based on a submitting. However Musk backed out of the deal.

Musk’s 81 million Twitter followers make him one of the vital well-liked figures on the platform, rivaling pop stars like Ariana Grande and Girl Gaga. However his prolific tweeting has typically gotten him into hassle with the SEC and others.

Musk and Tesla in 2018 agreed to pay $40 million in civil fines and for Musk to have his tweets accredited by a company lawyer after he tweeted about having the cash to take Tesla non-public at $420 per share. That didn’t occur however the tweet brought about Tesla’s inventory worth to leap. Musk’s newest hassle with the SEC could possibly be his delay in notifying regulators of his rising stake in Twitter.

Musk has described himself as a “free speech absolutist” and has stated he doesn’t assume Twitter resides as much as free speech rules — an opinion shared by followers of Trump and quite a lot of different right-wing political figures who’ve had their accounts suspended for violating Twitter content material guidelines.

Shares of Twitter jumped 11% earlier than the market open. The inventory continues to be down from its 52-week excessive of about $73. Shares of Tesla, the electrical automobile producer that Musk heads, slipped about 0.9%.

Post a Comment