2019 was a reasonably thrilling 12 months for me.

I stole a Tesla. I bought right into a automotive accident — a BMW, that point. I bought a brand new iPhone. I opened two new checking accounts and went on a bad-check-writing spree for as a lot as $13,000 at a time. I tried to open dozens of recent bank cards. I wrote a examine for somebody’s bail, which they skipped.

On paper, Jessica Roy had a wild 12 months. In actuality, that 12 months, and what adopted, has been a nightmare.

I'm the sufferer of identification theft. And it may occur to you. I even have some unhealthy information: It is going to be totally your downside, and nobody — not the police, not the federal government, not the monetary establishments — actually cares or will enable you to a lot. However with willpower, you may struggle again. I did.

My troubles began in a bar in San Francisco the day after Thanksgiving 2018. After I went to shut my tab, I found my pockets was gone. By the point I bought my financial institution on the telephone the subsequent morning, my debit card had been used at a gasoline station for $48.15 and with a Sq. card reader for $30. I disputed each transactions and canceled all my playing cards. I went to a San Francisco police station to report the stolen pockets.

After I bought residence to L.A., I needed to get a brand new driver’s license, needed to replace my autopay payments and had to purchase a brand new pockets. I assumed that was the top of it.

(I’d additionally misplaced perhaps $100 in outdated present playing cards, $10 in money, and a Pores and skin Laundry loyalty card. Devastatingly, I used to be only one punch away from a free facial.)

Then the letters began arriving.

“Congratulations! We’re happy to tell you that your utility for a brand new Wells Fargo account has been authorized.”

“Welcome to Financial institution of America, and thanks once more for selecting us.”

Goal known as asking about my current card utility.

Emails began arriving from my current bank card accounts:

- Electronic mail change alert. (The thief tried, however failed, to entry my Gmail account that had two-factor authentication enabled. They made a brand new one with my identify and used that as an alternative.)

- Password change alert.

- Cell system telephone quantity change.

I bought an e-mail from the monitoring website I exploit to trace my credit score rating. “Is This New Card Yours?” One other one: “A New Inquiry on Your Equifax Report.” PayPal. Walmart. Macy’s.

I’m a lady of motion, and I bought transferring quick. I froze my credit score with all three main bureaus and in addition froze my file with ChexSystems, the patron reporting company that tracks checking account exercise. I filed a federal identification theft grievance. I left what could be the primary of many voicemails with the San Francisco Police Division to get a replica of the report about my stolen pockets.

After I reached out to Financial institution of America and Wells Fargo to get the fraudulent accounts closed, I shortly encountered an issue: Their automated telephone menus demand your account quantity earlier than connecting you to a human being. However the letters I acquired didn't have the brand new account numbers on them. For safety functions.

When the primary Social Safety numbers have been issued in 1936, they have been by no means meant to be a safe identification signifier, however the main credit score bureaus started linking your Social Safety quantity to your credit score historical past round 1991.

Outrage No. 1

I began noting how lengthy I spent on maintain. Financial institution of America holds the report: 47 minutes. As soon as, an affiliate named Logan informed me I wanted to make a press release and go to any Financial institution of America department to get it notarized. My native department didn't have a notary, they stated once I bought there, and in the event that they did, I might have wanted to make an appointment. Again to the telephone queue.

Two years earlier than that, one other new idea had emerged on the planet of non-public finance: the credit score rating. It was a technique to crunch all the info in your credit score historical past into one quantity that now serves as shorthand for whether or not somebody ought to finance your automotive mortgage, allow you to purchase a home, or perhaps hire you an condominium.

Right this moment, Social Safety numbers and credit score scores are broadly criticized by monetary consultants and authorities officers as overly simplified and, typically talking, unhealthy.

And your Social Safety quantity isn’t very safe, even with the people who find themselves presupposed to be securing it. In 2017, the names, addresses, birthdays and Social Safety numbers of 147 million Individuals have been compromised in a hack of Equifax, a kind of firms that calculates your credit score rating. I used to be amongst them.

For our troubles, Equifax supplied a piddly $125 and a few free credit score monitoring. Then it turned out the bureau by no means put aside sufficient cash to pay all of the victims. I filed as a sufferer again in 2019. I haven’t seen a dime, and I don’t anticipate to.

However what does an enormous information breach should do with my pockets being stolen?

The thieves have been doubtless capable of get hold of my Social Safety quantity and different details about me on the market on the web. Whether or not that information got here from the Equifax hack or from a knowledge breach at one other establishment is unclear.

An Equifax consultant stated in an e-mail that “we're conscious of no proof that the breach has resulted within the impacted shopper information having been bought or used.” Equifax declined to remark additional for this story.

Outrage No. 2

Two addresses belonging to the individuals who stole my identification seem on my Equifax credit score report back to this present day. These addresses are in cities I’ve by no means set foot in. I filed a dispute on the uncooperative Equifax web site. Two days later, I see that I can obtain a PDF for the small print of the decision: “Oops. One thing went flawed. Please strive once more later.” Each time.

In any occasion, stolen Social Safety numbers are usually not laborious to come back by on-line, Eva Velasquez informed me. She’s the president and CEO of the Identification Theft Useful resource Middle, an advocacy group devoted to serving to victims of identification theft.

Her group sees sheaves of Social Safety numbers accessible as “buy-one-get-one” offers packaged with different shopper information on supply.

“They've been so ubiquitously compromised that they're accessible, basically, free of charge,” she stated.

I began a Google Doc monitoring each letter, e-mail and telephone name; a bodily file folder, quickly bulging, stored every thing in a single place. I felt bile rise in my throat each time I opened my mailbox. Each day, for weeks, there was one thing new. Generally a number of somethings.

I might sit at my kitchen desk and name the 800 numbers of the banks or bank card firms or automotive mortgage brokers and struggle the automated telephone menus in a determined bid to talk to a human being.

The thieves, in the meantime, have been on a roll.

Though my driver’s license had been reported stolen, Financial institution of America and Wells Fargo issued checkbooks to accounts opened utilizing it.

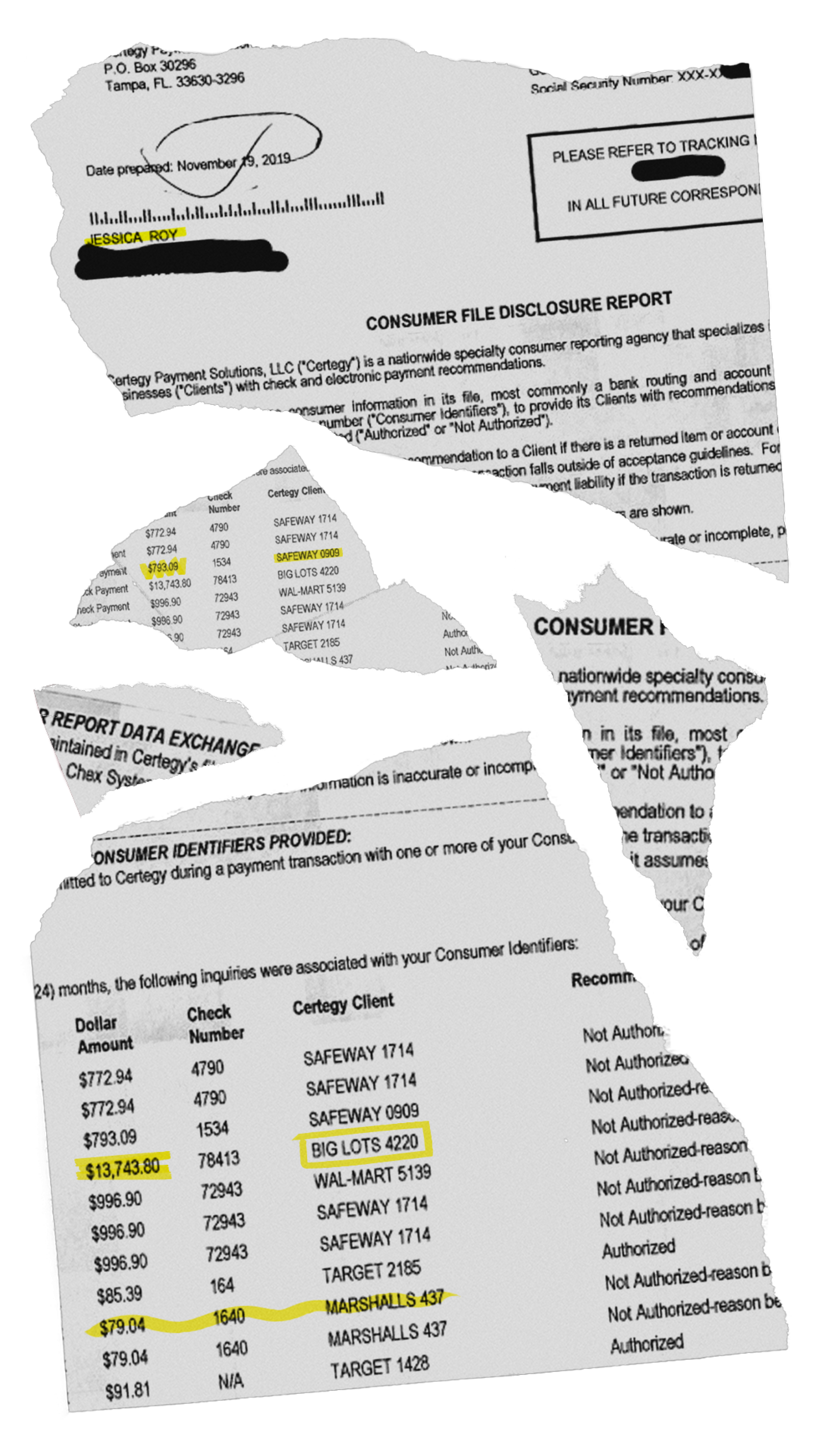

I began getting letters about unhealthy checks:

- $79.04 at Marshalls.

- $772.94 at Safeway.

- $13,743.80 at Massive Tons.

I started to understand that I used to be not solely the sufferer of identification thieves, but additionally of the system that allowed them to steal my identification within the first place. And now, that system was going to make me work an unpaid part-time job preventing my approach out of their logistical labyrinth. Kafka would blush.

Financial institution of America requested me to mail it a notarized affidavit, a replica of my driver’s license and a replica of my Social Safety card so it may examine the unhealthy checks. I replied that it could be insane for a sufferer of identification theft to place these issues within the mail. The particular person I spoke to stated, “We'd by no means require you to ship any info like that.” I used to be holding the letter asking for simply that on Financial institution of America letterhead.

That letter stated I had 30 days from the date of my declare — Jan. 25 — to fill out and return the kinds. I requested why the discover was dated Feb. 25. The consultant stated the financial institution had first mailed the letter to the latest tackle on file — an tackle I reported as fraudulent. The place the place the thieves lived.

Banks need it to be straightforward to open an account. As Velasquez put it, customers “desire a zero-friction expertise,” which explains how the thieves have been capable of open checking and saving accounts.

Months later, as I attempted to shut them, Andre from the Wells Fargo fraud division quizzed me on road names the place I’d lived and folks with whom I’d related to ensure I actually was who I stated I used to be. That isn't a part of the method to open a brand new account — simply to get a fraudulent one closed.

Defending your identification

There isn't a technique to utterly stop identification theft. However taking these steps may help stop it — and reduce the impression if it does occur.

In April, issues started to escalate.

One of many thieves used my driver’s license to hire a Tesla that was later reported stolen after which discovered deserted. One other time, somebody introduced my driver’s license to police after getting right into a automotive crash in a BMW. I bought a telephone name from the opposite driver’s insurance coverage firm months later.

“I” had written a examine for somebody’s $600 bail, that somebody by no means made it to courtroom, and I now owed $4,310. The bail bond firm informed me to come back to their workplace in particular person with the debt assortment letter and a tough copy of my police stories. I stated their authorized division must make me. The person I used to be talking to informed me to have a pleasant day and hung up. Ultimately, they closed the case.

Once you ask an organization to lend you cash, the corporate asks the credit score bureaus to examine your credit score historical past. There are two kinds of inquiries: “gentle” and “laborious,” referring to their impression in your credit score.

Outrage No. 3

A debt collector in Tuscaloosa, Ala., despatched me a set letter in regards to the unhealthy checks I’d written at a Kohl’s and a Michael’s. They gave me a fax quantity to ship them the police stories. The fax quantity didn't work.

Tender credit score checks, that are widespread for issues like retailer bank cards and web impulse purchases, don't have an effect on your rating. Laborious inquiries are extra in depth, and prompted by big-ticket issues like auto loans and mortgages. A tough inquiry usually dings your rating by some extent or two, and that impression lasts for one 12 months.

When your credit score is frozen, a tough inquiry into your historical past tells the creditor, “this account is frozen, so you may’t entry that info.” However for causes I can neither fathom nor clarify, the inquiries nonetheless present up in your credit score report and nonetheless have an effect on your rating.

One of many thieves triggered a tough inquiry at a automotive dealership in Van Nuys. I assume the thieves wanted new wheels after issues didn’t work out with the Tesla and BMW.

I needed to get the laborious inquiries eliminated on precept. The credit score rating impression was negligible. However I needed no hint of those individuals on my beforehand unblemished monetary personhood.

Step one to get a tough inquiry eliminated is to name the creditor — on this case Russell Westbrook Chrysler Jeep Dodge Ram of Van Nuys — and ask them to ship a “letter of deletion” to the credit score bureaus. I left a number of voicemails. The particular person I lastly spoke to stated he had labored there for 26 years and had by no means achieved this earlier than.

I succeeded in getting laborious inquiries eliminated at different establishments, however after a number of irritating telephone calls, I conceded bureaucratic defeat on the Russell Westbrook one.

The thieves, it appeared, knew every thing about me, and I knew nothing about them.

Then in Might 2019, I discovered the Berkeley police have been making an attempt to succeed in me.

A month earlier, a Berkeley police officer observed a automotive with out license plates. The 2 individuals within the automotive have been on probation for identity-theft-related felonies. Within the automotive, police discovered checkbooks, bank cards, photocopies of IDs, and different info for greater than a dozen individuals, lots of whom had reported stolen identities.

Together with me.

The Cheez-It field was probably the most galling half.

1 / 4-inch-thick police report detailed what police discovered within the couple’s automotive: stolen mail; wire cutters; lock picks; a window punch; cellphones; a number of pretend IDs, items of paper with names and Social Safety numbers scrawled on them; a stun gun.

A photocopy of my driver’s license. A Wells Fargo card with my identify on it. Paperwork from a Greatest Western with my identify on it.

A handgun.

And a Cheez-It field with a dozen checkbooks stuffed in it.

My total identification theft expertise thus far had been rife with indignities massive and small. And now my favourite snack meals had been implicated.

Outrage No. 4

I known as Transunion to get a replica of my credit score report. The particular person I spoke to stated I may solely request one free copy of my credit score report each 12 months, and I had already requested it in December 2018. She informed me I may pay $11 for one more one. I informed her that wasn’t me; it was the individuals who had been committing identification theft in opposition to me. She repeated that I used to be not eligible for one more free copy of my report till December 2019.

I’m not pleased with this, however I screamed at her. “YOU SENT MY CREDIT REPORT TO THIEVES.” She transferred me to a supervisor. A free copy of my report was mailed, lastly, to me.

I'm not naming the individuals who stole my identification, for my very own security. I'll seek advice from them as Thief 1 and Thief 2.

An officer requested Thief 1 in regards to the Greatest Western paperwork — who was Jessica Roy? A good friend, he stated.

Police additionally recovered a cellphone the place somebody had texted him a couple of native credit score union the place he ought to open an account: “The opposite banks are up on the s— and good for placing additional holds earlier than u can truly withdraw cash on deposits.”

Thief 2, a lady, was on probation for possession of stolen property.

Each have been booked on a number of prices, together with California Penal Code 530.5(c)(3): possessing the identification of 10 or extra individuals with the intent to defraud. Every part discovered within the automotive was logged as proof, together with the Cheez-It field.

Is my expertise distinctive? The main points, sure. However the crime, no.

A current survey performed by Javelin Technique and Analysis and co-sponsored by the three main credit score bureaus discovered 42 million Individuals have been affected by some type of identification fraud in 2021. Whole losses: $52 billion.

There isn't a single nationwide public database that tracks identification theft, or any cybercrimes, the way in which that we observe violent and property crimes. And there's no legislation enforcement company devoted to investigating cybercrimes at a person stage, so it’s laborious to say exactly how prevalent identification theft is.

Shima Baughman, a prison legislation professor on the College of Utah’s School of Legislation, informed me police don’t report identification theft instances to the FBI, however to the Federal Commerce Fee. In its 2021 information e book, the FTC notes that it doesn't intervene in particular person instances however refers the info again to legislation enforcement.

Outrage No. 5

The thieves wrote a nasty examine for $94.45 at a Dealer Joe’s in Modesto. The examine had my center identify, final identify, and metropolis spelled flawed, and the flawed condominium. Why had the examine been accepted within the first place?

The FTC report stated its Client Sentinel Community took in additional than 1.43 million stories of identification theft in 2021 — a report excessive.

You'll be able to report a cyber crime to the FBI via its Web Crime Grievance Middle, which was one of many first issues I did. Submitting the grievance generated a report, which was useful to have. However stolen driver’s licenses and unhealthy checking accounts are usually not precisely within the FBI’s wheelhouse. The FBI’s grievance middle acquired 51,629 stories of identification theft in 2021, additionally a report excessive.

Why are identification theft instances on the rise? For one, they're straightforward to commit.

“It was that you simply needed to have some savvy to commit these crimes,” Velasquez stated. Not anymore: “You simply want an web connection.”

Suicide prevention and disaster counseling sources

In case you or somebody you understand is combating suicidal ideas, search assist from an expert and name 9-8-8. America’ first nationwide three-digit psychological well being disaster hotline 988 will join callers with educated psychological well being counselors. Textual content “HOME” to 741741 within the U.S. and Canada to succeed in the Disaster Textual content Line.

Victims stand to lose way more than cash. The Identification Theft Useful resource Middle places out an annual report that appears on the toll identification theft takes.

In 2022, 87% reported emotional and bodily impacts, feeling frightened, violated, indignant, responsible. Ninety-two p.c had hassle sleeping. Forty-two p.c reported persistent aches and pains. Seventeen p.c developed unhealthy or addictive behaviors. Ten p.c reported feeling suicidal.

Victims additionally have been requested how lengthy it had taken to totally resolve their identification theft. Fifty-five p.c stated they by no means did.

Earlier than Thief 1 and Thief 2’s trial in June 2019, the Alameda County district lawyer requested whether or not I needed to make a sufferer impression assertion. I did. Re-reading it, even now, is difficult. I informed them they stole my pockets throughout a troublesome time in my life: I’d had a miscarriage a pair months earlier. The pockets, of blue studded leather-based, had been a present from my grandmother earlier than she handed away.

“I really feel sick simply fascinated by having to relive all of this once more,” I wrote. “This has been a profound private violation that has considerably affected my psychological well being. My therapist thinks the stress from coping with that is a part of why I haven’t been capable of get pregnant once more.”

“I don’t know if [Thief 1] or [Thief 2] will ever learn this assertion,” I wrote. “In the event that they do: I discovered each of you on Fb. It seems such as you each have youngsters. That should be fantastic — I wouldn’t know. Did you assume this was a victimless crime? Did you ever assume you have been stealing not solely somebody’s bank card info, however their likelihood to be a mom?”

Outrage No. 6

I reported my pockets stolen to the San Francisco Police Division on Nov. 24, 2018. I left a follow-up voicemail message on Nov. 27. Nobody responded. When the mail began arriving with all of the unhealthy account info in January 2019, I noticed I wanted a replica of that report. I left 4 extra voicemails. Nobody bought again to me till I filed a data request for the report with my L.A. Occasions e-mail.

Thief 1 and Thief 2 every confronted a 12 months in jail however took a plea deal: 9 months in county jail, a six-month residential remedy program for drug dependancy, and 5 years of felony probation.

I felt like I may lastly loosen up. They couldn’t proceed their crime spree from a jail cell, proper?

One afternoon in August 2019, I bought a name on my desk telephone at The Occasions.

A person with a heavy accent requested if I used to be Jessica Roy. He wanted my assist. His girlfriend had hit him, tried to kill him. Really, his ex-girlfriend. He was on his technique to the police station.

I stated the identify of Thief 2. Was it her? No. He gave me a special lady’s identify. He believed she was stealing my identification and he needed me to report her to the police. He stated she’d used it to hire a automotive. He stated she’d just lately gotten out of jail and he discovered a bunch of mail in her automotive with my identify on it. He requested me to e-mail him so he may ship proof.

I emailed and requested him to ship no matter he had.

“Thanks jessica i ll contact you later as we speak ..im on the police workplace.”

Days later, he emailed me from a special tackle. He stated he didn’t have entry to his e-mail and he needed my cellphone quantity. I didn’t reply. One minute later, he wrote once more.

“How i can contact you Jessica Roy..are you able to name me at [redacted].or e-mail me you fhone mumber o name me non-public if you'd like...thanks Jessica “

Once more, I didn’t reply. Two hours later, he despatched me a 3rd e-mail with no physique textual content, simply two blurry photos of items of mail with my identify and an tackle in Richmond I acknowledged from my credit score stories.

Two hours after that, he emailed me once more with the complete identify and tackle of his (probably ex) girlfriend. Then he despatched one other e-mail: no message, simply two photographs somebody had taken of themselves in a mirror. Specific photographs, in lingerie.

Up to now, I had stored each piece of communication I’d acquired pertaining to my identification theft.

This e-mail, I hit “delete” instantly. It was time to go to the police.

The primary time I went to the Los Angeles County Sheriff’s Division station in West Hollywood, the particular person on the entrance desk stated this was a Richmond police concern. I known as Richmond. No, they stated, the report has to originate within the jurisdiction the place the sufferer resides.

I went again to the West Hollywood station.

The deputy behind the counter sighed as I pulled out two bulging file folders of documentation. He checked out it — the bodily manifestation of months of labor and anguish on my half — as if I’d come to indicate him my stamp assortment.

I recounted what had occurred since my pockets was stolen and stated that now an odd man had known as me and despatched me unsettling emails.

Outrage No. 7

On Transunion’s web site, it says “Transunion makes it straightforward to dispute inaccuracies!” Each time I attempted to do this in April of 2019, the web site was down.

“So,” he stated, expressionless. “You consider your self to be the sufferer of identification theft.”

I corrected him.

“I am the sufferer of identification theft.”

This was worse than getting the runaround from an automatic telephone menu. The bile tasted acquainted.

He advised I discuss to the financial institution and telephone firm first. I stated no. I needed somebody to take my report. It was a Wednesday afternoon in early September. He informed me it could be awhile. I used to be the one particular person there.

I’d come ready to attend. I’d packed snacks. I selected a spot on a bench straight throughout from him — the place he couldn’t search for with out catching my eye — sitting there patiently, smiling politely.

After virtually an hour, one other officer took my report.

I didn’t anticipate deputies to kind a posse and street journey as much as Northern California to interrupt down the particular person’s door. I assumed, or hoped, they might alert police in Richmond.

I adopted up a month later, in October. A detective informed me the case was marked as “pending.” He indicated there was some confusion about why I had police stories with the San Francisco police, and the Berkeley police, and now needed the Richmond police concerned.

One more reason identification theft instances are on the rise: “It’s actually troublesome to get arrested for committing cyber crimes. It’s very low threat and excessive reward,” Roger Grimes informed me. He’s a cybersecurity knowledgeable who’s written on the subject for years.

He and Velasquez described how criminals should buy terabytes of hacked private information and malware that automates opening bank cards and making use of for loans.

Baughman, the prison legislation professor, stated cyber crimes are wildly under-reported as a result of victims don’t assume the police can or will do something about it. They usually’re largely proper.

A part of the issue, she stated, is that these crimes cross conventional jurisdictions. (Certainly, after one other name to the West Hollywood station, I used to be informed it wasn’t clear whether or not the case was ever referred to Richmond.)

Your native legislation enforcement company is mostly within the geographic area it polices. Then there are clearance charges, the share of instances police clear up and a key metric they care about.Identification theft instances cross geographic traces and are laborious to clear, so police don’t actually need to take them, Baughman stated.

The one motive Thief 1 and Thief 2 bought arrested is as a result of they slipped up. It was a lucky (for me) coincidence, not the results of an investigation.

What to do in case your identification is stolen

In case your private info has been compromised, you want to act quick. Right here’s what to do.

On the night of the identical November day I’d spoken by telephone with, in line with my notes, an “extremely impolite lady” from the West Hollywood station, I bought a textual content and an e-mail confirming a marijuana supply order. Spam, I assumed. A short while later, I bought a telephone name: It was a marijuana supply driver. He was parked simply outdoors my resort in Petaluma with my order. May I come outdoors?

I emailed the marijuana supply firm, and the founder responded instantly. So far as he and I may inform, somebody had used my identify, e-mail tackle, date of delivery and telephone quantity to create an account, however they forgot to vary it to their very own telephone quantity once they positioned an order for $57 of Legend OG.

I forwarded the receipt to the L.A. County sheriff’s deputy assigned to my case, asking him to replace my report. We spoke by telephone the subsequent day. I had the precise tackle for the place these individuals have been staying, and proof that they’d been there the evening earlier than. Absolutely, the police in Petaluma may knock on the door and test it out.

The detective stated he’d discuss to his sergeant, however he wasn’t positive what they may do with that info.

On Christmas Day 2019, my telephone rang once more. It was my financial institution, the girl stated, and so they had a pair questions, and he or she simply wanted to confirm my identification earlier than she may go any additional. Positive. My identify, date of delivery, present tackle. And — simply to confirm — what was my account password?

I keep in mind precisely the place I used to be standing, in my dad and mom’ front room, my prolonged household gathered over vacation hors d’oeuvres. I appeared down at my glass of wine as a thought penetrated my vacation buzz: My password?

I hung up.

Outrage No. 8

I just lately discovered I'm listed on background checks as among the thieves’ “recognized associates,” doubtless due to the incident the place one in all them introduced my driver’s license after a automotive crash. A background examine on Thief 4 lists my new residence tackle.

One other telephone name. Jan. 3, 2020. An officer with the Vacaville Police Division — nicely, you may guess this subsequent half. A person and a lady arrested. Issues discovered within the automotive with my identify on them. I requested the officer if I may guess their names.

Thieves 1 and a pair of? No.

How in regards to the identify of the person who had known as me in August and his (probably ex) girlfriend?

Yup. That was them.

I requested for the officer’s e-mail. I had some issues to ship her.

Generally I really feel just like the heroine of a noir novel. A sufferer pressured to take the legislation into my very own fingers, utilizing shoe leather-based and good, old style know-how to resolve the tried homicide of my private funds.

However extra usually, I really feel like I’ve been victimized twice. As soon as by the individuals who plucked my pockets out of my purse. However a second time, and lots of extra instances over, by a system that's doing nothing to guard me — or any of us — and that pressured me right into a part-time, unpaid job cleansing up after the unhealthy system they created.

I’ve informed lots of people this story. They ask what they will do to guard themselves. The reply is hard. I work on a workforce targeted on service journalism and I’m used to saying, sure, in fact there’s one thing you are able to do about this.

On this case, I really feel like saying, “There’s nothing you are able to do! Good luck!”

I stated I wouldn’t let the thieves win, and I didn’t.

However that isn’t totally true. I stated I wouldn’t let the thieves win, and I didn’t.

In 2020, my husband and I made a decision to purchase a home. I needed to un-freeze my credit score to get a mortgage.

Lower than 24 hours after I unfroze all my credit score stories, I acquired an alert from one of many banks I exploit, thanking me for making use of for a brand new checking account. I logged in and noticed that my mailing tackle had been modified to at least one in Northern California. I known as the financial institution in tears to repair the issue and requested what I may do to make it cease. The customer support rep’s response: nothing.

“If we may stop all fraud from occurring we might, however we will’t,” they stated breezily.

When the mortgage firm despatched my husband and me the finished utility to overview, three of the addresses on it belonged to the thieves. I bought to ship one more e-mail with a number of police stories connected.

However finally, the mortgage did undergo, and we moved into our first residence that summer season. And this 12 months, in February, we introduced our first child residence from the hospital.

I used to be on maternity depart till August. After I bought again, my editor requested me what story I needed to work on subsequent. You’re studying it.

Different victims of identification theft have in contrast it to managing a persistent situation, Velasquez informed me. You might have intervals of remission, however then should battle flare-ups unexpectedly, and at all times on the worst instances (like once you’re making use of for a mortgage). However it's manageable.

What stood out to me, time and again, was that this wasn’t one thing I may have prevented, and never one thing I ought to have been anticipated to single-handedly repair. It is a systemic downside that can require systemic options.

Post a Comment