With tax season already underway — the submitting deadline this 12 months is April 18 — complaints in regards to the Inner Income Service are already rolling in.

We’re not referring to complaints about taxes normally — these are all the time with us, in any case — however complaints in regards to the company’s buyer companies. Points similar to how lengthy it takes to reply the cellphone, course of returns and refunds and so forth.

These are likely to peak as tax day bulks massive on the horizon. This 12 months is not any exception. The complaints are most vociferously sounded on the correct — two current examples come from Nationwide Evaluate and the Cato Institute.

This seems to be just like the tax system of a plutocracy.

Emmanuel Saez and Gabriel Zucman, UC Berkeley

Blogger Kevin Drum rightfully condemns their grousing as manifestations of “brass,” for causes we’ll cowl in a second. However they’re felt by any taxpayer who, for one purpose or one other, wants to talk personally with an IRS representatives.

Issues obtained worse through the pandemic: One member of my quick household didn’t obtain his 2019 refund till the summer time of 2021, as an illustration.

However those that counsel that the IRS is chargeable for its personal issues are blowing a thick cloud of smoke. That’s as a result of discovering the explanation for the company’s underperformance in buyer phrases requires trying elsewhere — particularly, on Capitol Hill.

Anti-tax conservatives in Congress have been systematically impoverishing the IRS for many years, with the unmistakable aim of undermining its capacity to do its job, to not point out its public repute.

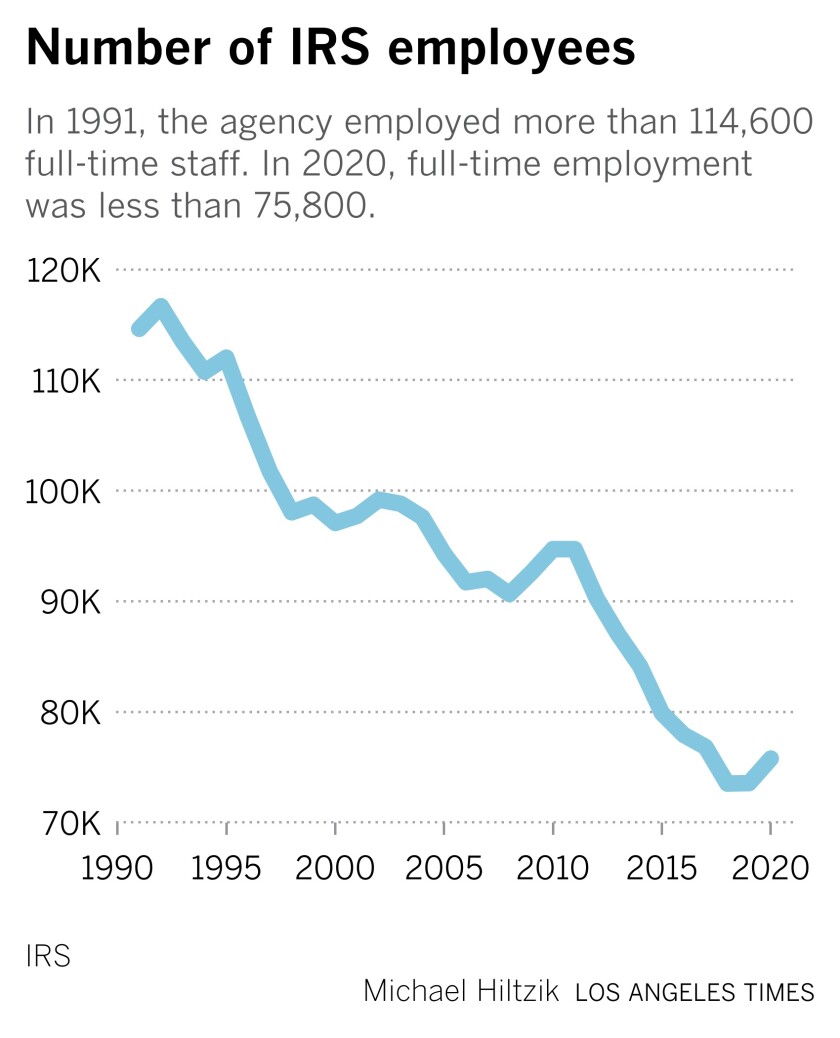

Listed here are the related statistics: In 1991, the company employed greater than 114,600 full-time workers to serve a inhabitants of 254 million and accumulate about $1.1 trillion in income. In 2020, based on the most up-to-date IRS Reality Guide, full-time employment was fewer than 75,800, serving greater than 330 million Individuals and amassing $3.5 trillion.

Simply during the last decade, the company’s price range has declined by 20% in inflation-adjusted phrases.

The precise wing insists that by some means the IRS deserves much less funding. That’s the purpose made by Dominic Pino of Nationwide Evaluate: “The IRS is clearly a poorly run group, and poorly run organizations shouldn't be rewarded with extra money,” he writes.

“If the company truly improved its processes and higher served taxpayers, its case for funding will increase would weaken,” Pino writes, although the way it improves its efficiency when it doesn’t get sufficient funding to do the job it has now, he doesn’t clarify.

Pino attracts his information from a screed by Chris Edwards, the tax coverage chief on the Cato Institute. Each cite statistics printed by the IRS Nationwide Taxpayer Advocate, which disclosed final 12 months that solely 11% of calls to the company obtained answered.

That was “the worst it has ever been,” the advocate lamented. The advocate additionally reported that processing correspondence, which used to take about 45 days, now can take six months or longer.

Because it occurs, Edwards is marginally extra charitable towards the IRS than Pino. He acknowledges, not less than, that “the pandemic prompted the IRS to shut or understaff quite a few amenities in 2020,” and that “Congress has been passing large and sophisticated tax breaks and subsidies for the IRS to manage.”

Every change, Edwards concedes, requires the IRS to create new tax types, reprogram its computer systems, and take different steps that may “immediate tens of millions of queries from confused taxpayers, which in flip consumes extra IRS assets in response.”

It’s correct to look at the political surroundings through which the IRS operates. Put merely, it’s one which favors the wealthy. The very best-earning taxpayers have seen their tax charges and audit charges fall sooner than everybody else through the years.

In accordance with a paper final 12 months by John Guyton and Patrick Langetieg of the IRS and colleagues at UC Berkeley, Carnegie Mellon and the London College of Economics, IRS insurance policies have fostered widespread tax evasion on the high of the revenue ladder.

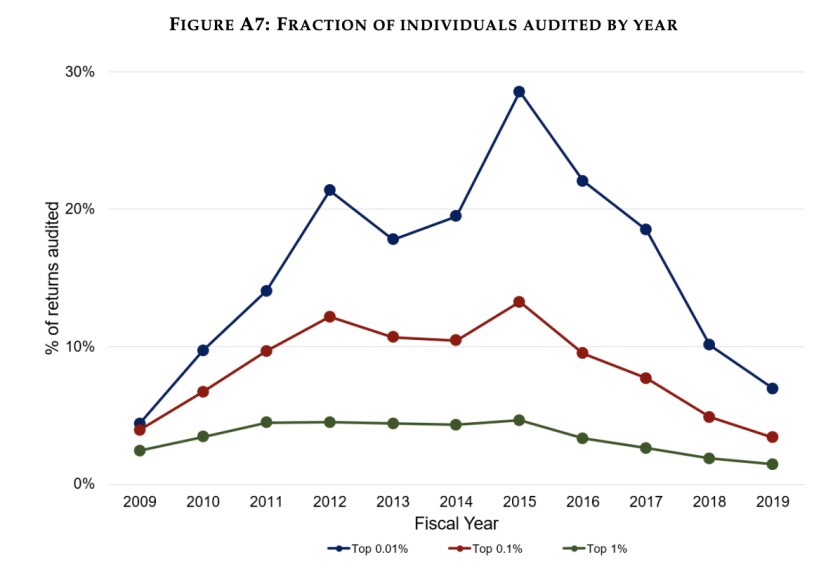

The share of audits carried out every year of the highest 1%, for instance, fell from practically 30% to lower than 10% from 2015 via 2019.

As I reported in 2020, about 23,450 U.S. households reported revenue of $10 million or extra within the 2018 tax 12 months, averaging greater than $26 million every in taxable revenue — the best revenue bracket. Underneath the Trump administration, the IRS, based on its 2019 information ebook, audited seven of them. (Acknowledgements to journalist David Cay Johnston, who first ferreted out the statistic from IRS information.)

That audit charge of three-hundredths of 1 p.c is in regards to the likelihood of your being struck by lightning in some unspecified time in the future in your lifetime. So it will not be stunning that rich taxpayers don’t assume they've a lot to concern from IRS.

Trump could also be out of workplace, however his strategy to IRS enforcement continues to be being heard.

Final November, after President Biden proposed making an $80-billion funding within the IRS over a decade partially to improve collections efforts, David Kautter, a former performing IRS commissioner below Trump, snarked that the funding was “dramatically in extra of what the IRS wants and will most likely successfully use.”

Nicely, he would say that, wouldn’t he?

The company’s enforcement indulgence for the rich comes on high of the positive aspects the identical folks have scored of their tax charges, additionally thanks primarily to Republican initiatives.

From 1960 via 2018, based on calculations by Emmanuel Saez and Gabriel Zucman of UC Berkeley, the full wealth of the underside 50% of U.S. revenue earners rose by about 1.5 instances, from a mean $3,500 to $5,200 (in 2018 dollars) and their common tax charge rose from 22.55% to 24.2%.

The wealth of the 400 richest Individuals, nevertheless, rose by greater than 24 instances, from a mean $276 million to a mean $6.7 billion (additionally all in 2018 dollars), whereas their common tax charge declined from 54.4% to 23%.

“This seems to be just like the tax system of a plutocracy,” Saez and Zucman wrote of their 2019 ebook, “The Triumph of Injustice.”

With tax charges on the high barely exceeding 20%, they noticed, “wealth will preserve accumulating with hardly any barrier. And with that, so too will the facility of the rich accumulate, together with their capacity to form policymaking and authorities for their very own profit.”

The impact they recognized could possibly be seen through the course of the good IRS “scandal” of 2012 and 2013, ginned up by GOP functionaries similar to then-Rep. Darrell Issa, (R-Vista) (then recognized as the richest member of Congress).

Issa claimed that the company had focused conservative tax-exempt nonprofits for scrutiny over whether or not they had been truly political fronts, which might be unlawful. His purported investigation succeeded in intimidating the IRS from doing its job, which allowed nonprofits — C4 teams in formal parlance, that are presupposed to restrict their actions to social points, not politics — to maintain funneling illicit contributions to politicians.

In the long run, it turned out that the scandal was a fantasy. An exhaustive research by the Heart for Public Integrity recognized solely 10 C4s whose functions for tax-exempt standing had been rejected by the IRS since 2010. Amongst them had been seven Democratic-affiliated organizations.

However these inquiries had been the final of their variety. After Issa’s investigation, “the IRS’ nonprofit division ... successfully misplaced no matter nerve it had left,” the middle reported. Among the many beneficiaries of its paralysis was what was then the largest “social welfare” entrance, Karl Rove’s Crossroads GPS.

One could be tempted to say, “mission achieved.” Sadly, nevertheless, the mission of hobbling the IRS is rarely full within the eyes of its enemies in Washington.

So if you happen to turn into irritated on the IRS’s unresponsiveness to your workaday inquires, you need to keep in mind that its shortcomings are brought on by the actions of lawmakers. Because of them, the company is provided to be conscious of a sure class of taxpayers — wealthy ones.

Post a Comment